That $15,000 commercial pizza oven you bought three years ago isn’t worth $15,000 anymore—and that’s actually a good thing for your taxes.

Restaurant equipment loses value over time through normal wear and tear, technological obsolescence, and simple aging. But instead of treating this as a negative, smart operators can use machinery and equipment depreciation as a powerful financial tool to reduce tax liability, plan for future purchases, and maintain accurate books that attract investors and lenders.

What Equipment Depreciation Really Means for Restaurant Operations

Equipment depreciation is the process of spreading the cost of a major purchase across its useful life rather than taking the full expense hit in year one. Understanding machinery and equipment depreciation life is essential for restaurant operators making significant capital investments. Think of it as the accounting equivalent of paying for expensive equipment over time instead of all at once—except you already paid for it, and now, you’re spreading the tax benefits over several years.

For example, say you purchase a $20,000 commercial dishwasher. Instead of claiming the entire $20,000 as an expense in year one (which would create a massive swing in your profit margins), you spread the cost over its useful life. Under straight-line depreciation, that would mean about $2,857 each year for seven years. In practice, most restaurants use the IRS’s MACRS schedule, which accelerates deductions—allowing larger write-offs in the early years and smaller ones later on.

This approach serves three functions for restaurant operators. First, it smooths out profit and loss (P&L) statements, which prevents dramatic spikes and dips. Second, it provides ongoing tax deductions that reduce your annual tax burden. Third, it helps you track the actual value of assets for insurance, lending, or potential sale purposes.

The Two Depreciation Methods Every Restaurant Owner Should Know

1. MACRS (Standard Approach)

The Modified Accelerated Cost Recovery System (MACRS) is the default depreciation method used by most restaurants. Under MACRS, different types of equipment have predetermined useful lives set by the IRS. Most restaurant equipment falls into the 7-year category, though some items have shorter or longer timeframes.

MACRS uses an accelerated depreciation schedule, meaning you can claim larger deductions in the early years when equipment is newer and more valuable.

2. Section 179 (Immediate Write-Off)

Section 179 allows you to deduct the full purchase price of qualifying equipment in the year you buy it, up to certain limits. As of tax year 2024, restaurateurs can deduct up to $1,220,000 in qualifying equipment purchases—an attractive option for restaurants making significant equipment investments.

If you’re having a profitable year and want to reduce your tax burden immediately, Section 179 can provide substantial relief. If you prefer steady, predictable deductions over time, MACRS might be the better choice.

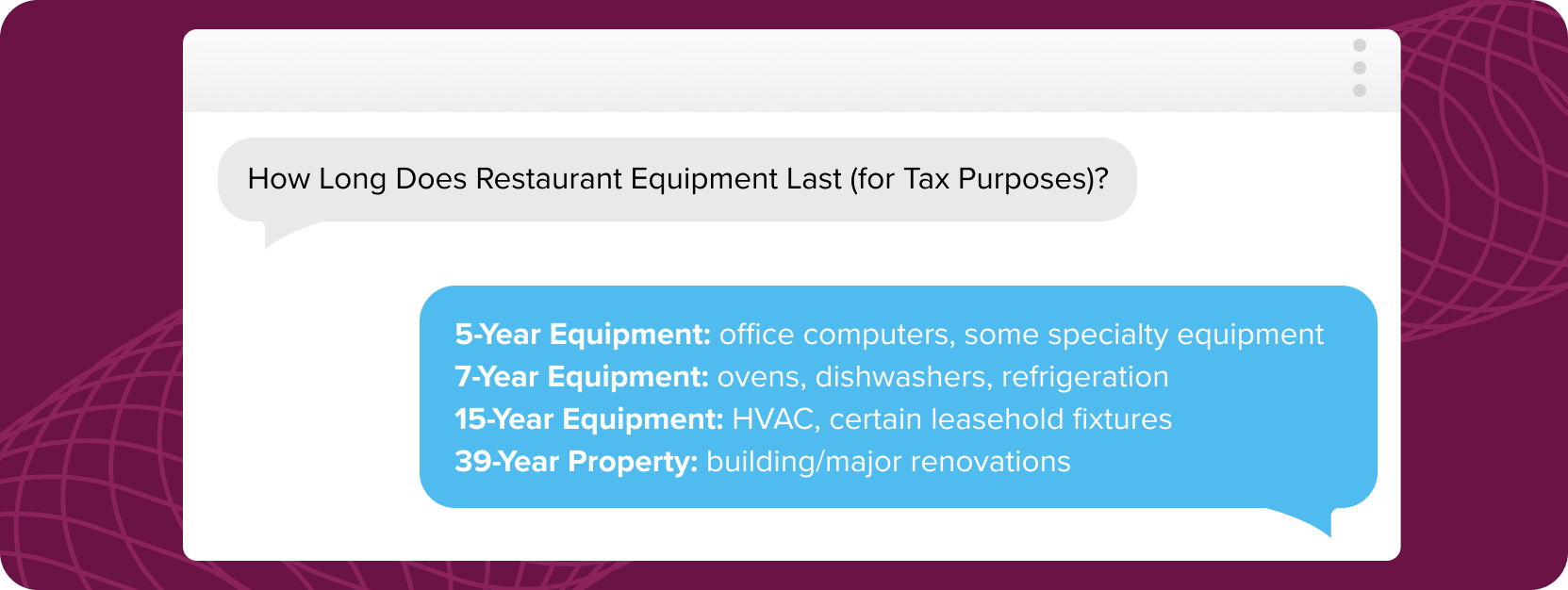

A Quick Reference Guide for Restaurant Equipment Depreciation Lifespans

The IRS sets specific machinery and equipment depreciation life schedules for different types of restaurant assets, which can help you plan both tax strategies and replacement schedules. For instance, if you’re planning to replace your aging walk-in cooler, timing the purchase strategically can maximize your current-year deductions.

5-Year Equipment:

- Computers and peripheral equipment

- POS systems (often classified as 5-year property for computer hardware/software, though some installations may fall into the 7-year category)

- Some specialized food service equipment

7-Year Equipment:

- Office furniture and fixtures

- Commercial ovens and ranges

- Dishwashers and warewashing equipment

- Food preparation equipment (mixers, slicers, processors, etc.)

- Refrigeration units and freezers

15-Year Equipment:

- HVAC systems (generally treated as 15-year property under current IRS rules, though some installations tied directly to the building structure may default to 39 years)

- Some leasehold improvements and fixtures

39-Year Property:

- Building structures and major renovations

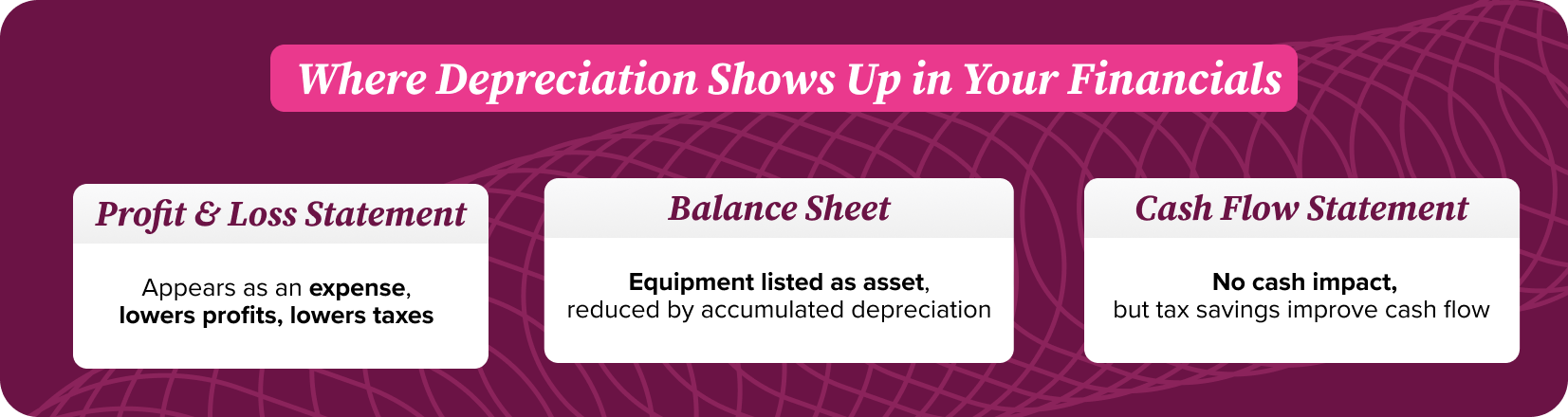

How Depreciation Impacts Your Key Financial Statements

P&L Statement

Depreciation appears as an operating expense on your P&L, reducing your reported profits and, consequently, your tax liability. Since depreciation is a non-cash expense, this creates a unique situation where cash flow can be stronger than reported profits.

Balance Sheet

On your balance sheet, equipment appears as an asset at its original purchase price. Accumulated depreciation, which is the total depreciation claimed over the years, appears as a contra asset, reducing the equipment’s book value. This gives lenders and investors a clear picture of your asset base and how much useful life remains in your equipment.

Cash Flow Statement

While depreciation reduces reported profits, it doesn’t affect your actual cash flow. In fact, the tax savings from depreciation deductions improve your cash position. A restaurant claiming $30,000 in annual depreciation could save $7,500 to $10,500 in taxes, depending on tax rates.

Common Depreciation Mistakes That Cost Restaurant Owners Money

- Forgetting to start depreciation: Some owners purchase equipment but never begin tracking machinery and equipment depreciation life, missing out on years of valuable tax deductions. Depreciation begins when equipment is “placed in service,” which is typically when it’s installed and ready for use.

- Mixing personal and business equipment: The IRS requires clear business-only usage for full depreciation benefits.

- Inadequate recordkeeping: Without proper documentation of purchase dates, costs, and business usage, depreciation claims can be questioned during audits. Maintain detailed records for every piece of equipment, including invoices, delivery receipts, and installation documentation.

- Ignoring improvement vs. repair distinctions: Routine maintenance and repairs are immediately deductible, while improvements that extend equipment life or increase capacity must be depreciated. Adding a new feature to your POS system is an improvement; fixing a broken screen is a repair.

Planning Your Equipment Replacement Strategy

Smart depreciation tracking can do more than save tax dollars—it can help you plan for the future. When restaurant equipment depreciation life reaches its end, it’s time to start budgeting for replacement. A 5-year-old commercial refrigerator that’s fully depreciated under MACRS might still have useful life remaining, but you should be setting aside funds for its eventual replacement.

Create an equipment replacement fund by setting aside a portion of your depreciation tax savings. If depreciation deductions save you $8,000 annually in taxes, consider depositing half of those savings into a dedicated equipment fund. When replacement time arrives, you’ll have cash ready instead of scrambling for financing.

Technology Solutions for Depreciation Management

Manual depreciation tracking through spreadsheets can become a challenge as your restaurant grows. Modern restaurant accounting software can automate depreciation calculations, maintain asset registers, and generate the reports your accountant needs for tax filings.

Quality restaurant management platforms integrate machinery and equipment depreciation life tracking with your existing financial systems, ensuring accuracy across your P&L, balance sheet, and cash flow statements. This integration becomes increasingly valuable as you add locations or equipment.

Taking Action on Equipment Depreciation

Machinery and equipment depreciation isn’t just an accounting exercise—it’s a strategic tool for building a more profitable, financially stable restaurant. Start by conducting an equipment audit: List every piece of equipment you own, its purchase date and cost, and current depreciation status.

If you’re handling depreciation manually or not tracking it at all, you’re likely leaving money on the table. Restaurant-specific accounting solutions can track restaurant equipment depreciation life automatically, ensuring you never miss a deduction.

The restaurant industry moves fast, and operators who leverage every available financial advantage, including proper depreciation management, can position themselves for sustainable growth. Your equipment is already losing value. Make sure you’re capturing every tax benefit along the way.

Ready to optimize your restaurant’s financial management? Learn more about comprehensive accounting solutions designed specifically for restaurant operators, or explore our financial reporting tools that integrate machinery and equipment depreciation life tracking with your financial statements.