Managing a successful restaurant requires a mix of culinary skills and shrewd financial management. Understanding the balance sheet is key to gaining insights into your business’s health and future direction. This guide simplifies balance sheets for restaurant owners, showing how you can use them for smarter decision-making and sustained success.

What Is a Restaurant Balance Sheet?

A basic restaurant balance sheet includes three main components: assets, liabilities, and equity. Assets include things that bring value to the business, such as the building owned by the company or cash on hand. Liabilities and equity include things owed out by the business, either in the form of payments owed to a vendor (a liability) or a promise of value owed to a stockholder or owner (equity). To prepare an accurate balance sheet, the assets (or value side) must balance with the liabilities and equity (or obligations side).

Restaurant Balance Sheet Formula

Assets = Liabilities + Equity

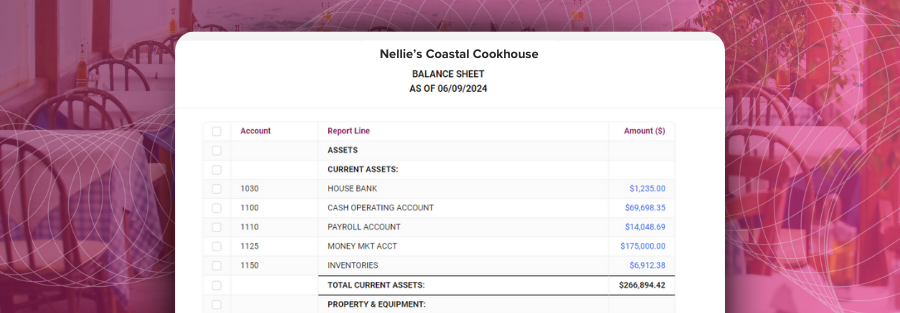

Sample Restaurant Balance Sheet Layout

Below is a sample layout showing how a restaurant’s assets, liabilities, and equity come together in a balance sheet. This example shows how a restaurant’s financial data is organized so you can quickly see what the business owns, owes, and retains.

Components of a Restaurant Balance Sheet

Each part of a restaurant balance sheet serves a specific purpose in understanding the business’s financial foundation. Looking at these components individually helps identify where money is tied up, how debt is managed, and what portion of the business truly belongs to the owner. This breakdown turns a static report into a practical tool for smarter financial decisions.

Assets

Assets represent resources owned by the restaurant that have economic value and can be converted into cash or used to generate revenue. The balance sheet includes assets to give owners and stakeholders a clear view of what the restaurant owns and its potential for future income. A balance sheet divides these investments into these specific asset classes:

Current Assets

Current assets are resources in your business that you can easily convert into cash within a year. Some common examples include cash on hand, accounts receivable (which represents purchases from customers on credit), and inventory.

Fixed Assets

Fixed assets include property, equipment, or other tangible items with more than one year of useful life. Examples of fixed assets in the restaurant industry include kitchen equipment like ovens and refrigerators, furniture, and the physical building in which the restaurant operates.

Financial Investments

Financial investments are assets that earn money for the business and operators can liquidate into cash if needed. Investments typically include accounts like CDs (certificates of deposit), bonds, or ownership holdings in other businesses.

Intangible Assets

Intangible assets are non-physical assets that have value for the business, such as intellectual property or brand recognition. Other examples for restaurant owners include trademarks or proprietary recipes.

Liabilities

Liabilities are the debts the business owes to others. They can be divided into current liabilities (due within a year) and long-term liabilities (due after a year).

Current Liabilities

Since current liabilities are due within one year or less, owners must keep an eye on this balance sheet category’s total to ensure the restaurant has enough liquid cash to meet these short-term obligations successfully. Common examples of current liabilities include short-term loans, payments due to suppliers, payroll due to employees, and any taxes owed.

Long-Term Liabilities

While long-term liabilities aren’t due immediately, restaurant owners should still monitor this category to ensure the business can meet its obligations and identify growing debts early. This category includes mortgages on any business-owned property and long-term loans for equipment or renovation.

Equity

Equity represents the value of the business that owners or shareholders own. It’s essentially the remaining value of the business after subtracting liabilities from assets. Businesses typically split this value between shares of stock outstanding (shareholders’ equity) and owners’ equity.

Why Is a Restaurant Balance Sheet Important?

A balance sheet provides a snapshot of the restaurant’s financial health. It helps owners and managers understand their current assets, liabilities, and equity, which can enhance business decision-making.

A balance sheet provides a snapshot of the restaurant’s financial health. It helps owners and managers understand their current assets, liabilities, and equity, which can enhance business decision-making.

Why Reading a Balance Sheet Is Important

As an operator, you should know what each category on your restaurant’s balance sheet represents and how various categories work together to show operational trends. Regularly reviewing your balance sheet can help you identify and fix problems faster. You can also use this tool to determine if changes to your business strategy have the desired impact.

Why Building a Balance Sheet Is Important

A balance sheet is one of the three core pieces of your restaurant accounting reports. Strategic owners use information across the balance sheet, profit & loss statement (P&L), and cash flow statement to get a clear, detailed view of the operation’s financial health and efficiency. Taking the time to build a balance sheet regularly ensures that you are “in the numbers” and fully informed on all aspects of your restaurant’s financial well-being.

Why Using a Balance Sheet Is Important

Preparing a balance sheet is only half the process. Balance sheets that sit on a dusty shelf in an office aren’t serving their intended purpose. Once you prepare your balance sheet, you should use it as an active tool in your business’s strategic planning. Identify key trends needing your attention and look for assets or other line items you can leverage to accomplish your goals.

Using a Balance Sheet Effectively

Want to invest in a new kitchen gadget? The balance sheet can help you identify whether your business stands on solid financial ground or if you should delay that purchase for a future business cycle. To use this tool effectively, you must follow a simple process that helps you zero in on a few key metrics.

How To Read and Interpret Your Restaurant Balance Sheet

- Review Total Assets: This is the cumulative value of what your business owns and can leverage to generate revenue. Higher assets relative to liabilities and equity indicate a strong financial position.

- Analyze Liabilities: Examine current and long-term liabilities to understand your restaurant’s financial obligations. A lower ratio of liabilities to assets suggests a healthier financial status, indicating your restaurant relies less on debt for operations or growth.

- Evaluate Equity: Analyze the equity section to determine the value remaining if you settle all liabilities with available assets. Increasing equity over time can signal that owners and stakeholders are retaining more of the business’s profits.

- Compare with Previous Periods: Compare the current balance sheet with those from previous periods to identify trends, which you can use for strategic decision-making and forecasting.

- Calculate Key Ratios: Utilize financial ratios to gain deeper insights into the restaurant’s financial stability and use resources more efficiently.

Key Metrics and Ratios for Restaurants

Your balance sheet contains important financial numbers that you can use to quickly identify your restaurant’s financial stability in specific areas. At a minimum, you should calculate the following ratios each period when analyzing your balance sheet:

- Current Ratio = Total Current Assets / Total Current Liabilities: This metric provides insight into your business’s short-term financial health. A healthy business will have a current ratio of greater than 1, meaning there are more current assets than current liabilities, and the business should be able to cover its short-term obligations.

- Quick Ratio = Quick Assets / Total Current Liabilities: Quick assets refer to the most liquid resources, such as cash or accounts receivable. Like the current ratio, a quick ratio of greater than 1 indicates the business is in a strong position to meet its short-term obligations.

- Return on Equity (ROE) Ratio = Net Income / Average Shareholders’ Equity: Companies with stockholders use this metric to identify how effectively the business uses shareholder dollars to turn a profit. A higher ROE ratio indicates the business uses the shareholder investments it receives more efficiently, which is ideal for investors.

- Inventory Turnover Ratio = Cost of Goods Sold / Average Inventory: This measurement assesses how often a company sells and replaces its inventory during a specific period. A higher inventory turnover ratio indicates the business quickly sells items as they’re purchased, which minimizes backlog, holding costs, and waste.

Common Restaurant Balance Sheet Mistakes to Avoid

Avoiding mistakes in balance sheet preparation is crucial for accurate restaurant accounting. The following points highlight some of the most common errors that can adversely affect a restaurant’s financial analysis and reporting.

Inaccurately Recording Transactions

Inaccurate recording typically involves overestimating assets or underreporting liabilities. This misclassification skews the business’s financial outlook and can lead to misguided strategic decisions.

Improper Inventory Tracking

Proper restaurant inventory management involves tracking price changes and logging waste or spoilage. Failing to account for these factors can lead to significant discrepancies on the balance sheet, particularly in the assets category.

Misclassifying Balance Sheet Line Items

Misclassifying can occur when operators improperly categorize certain line items. This error typically occurs when long-term items get categorized as current items or vice versa. Since many common ratios are based on current asset or liability numbers, misclassifying can obscure the restaurant’s true financial position, leading to poor decision-making.

Ignoring Your Balance Sheet

Many operators diligently check their P&L on a regular basis, but they tend to ignore the balance sheet until tax time. Unfortunately, this lack of attention can lead to missed inaccuracies and operational problems that they could have identified sooner with a regular balance sheet review.

Managing Your Restaurant Finances With a Period-End Review

After creating your balance sheet, it’s time to check for consistency and accuracy in a Period-End Review. Ideally, you’ll complete this activity by comparing the three common financial reports: the balance sheet, profit & loss statement, and cash flow statement.

After creating your balance sheet, it’s time to check for consistency and accuracy in a Period-End Review. Ideally, you’ll complete this activity by comparing the three common financial reports: the balance sheet, profit & loss statement, and cash flow statement.

How To Complete a Period-End Review

- Reconcile All Accounts: Reconcile all bank and cash accounts to ensure accuracy. Next, compare the account statements with the recorded transactions in the restaurant’s accounting system.

- Review Financial Statements Side-by-Side: Compare the three core financial statements side-by-side for the review period. Look for inconsistencies or irregularities that could indicate errors, potential theft, or other areas of concern.

- Assess Inventory Changes and Costs: Evaluate the Inventory Turnover Ratio and check for significant changes in inventory levels and costs. Ensure that the cost of goods sold (COGS) accurately reflects the inventory consumed during the period.

- Consult With a Financial Advisor or Accountant: After you conduct the initial review, it’s beneficial to consult a financial advisor or accountant. They can provide an expert analysis of the financial statements, offer insights into financial trends, and suggest corrective actions for any identified issues.

Getting the Most Out of Your Restaurant Balance Sheet

A well-maintained restaurant balance sheet is not just a financial statement; it’s a tool that, when used correctly, can significantly contribute to a restaurant’s success. To get the most out of your balance sheet, take proactive steps to ensure the numbers that go into your balance sheet accurately depict your restaurant’s financial position.

Fortunately, you don’t have to manage your financial reporting alone. The Back Office accounting experts can help you learn how to automate your balance sheet creation and use it as a strategic tool in your operations.