You just closed the books for the month, the P&L shows a healthy profit, and yet, your bank account is running on fumes. How can that be?

For restaurant operators, the terms cash flow vs. profit often get used interchangeably, but they measure two very different aspects of your business. Understanding this distinction is not just a detail for your accountant to worry about — it could mean the difference between staying open another year or closing your doors early.

Without a strong handle on these restaurant cash flow management terms, operators risk payroll shortfalls, unpaid invoices, and missed opportunities to reinvest in growth. Simply put, profit looks good on paper, but cash flow is what keeps your restaurant running day to day.

What Profit Really Means

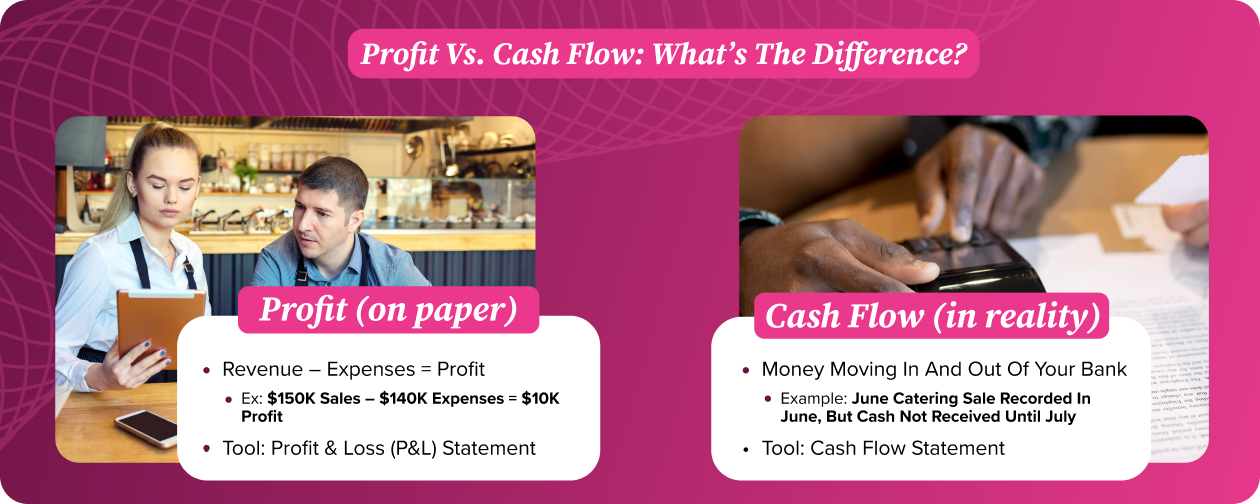

Profit is often the first number restaurant owners look at when reviewing their financials. In simple terms, profit is what’s left after you subtract all your expenses — food, labor, rent, utilities, marketing, and more — from your total revenue. For example, if your restaurant sells $150,000 in a month, and your expenses for that month total $140,000, you’re left with $10,000 in profit.

The primary tool for measuring profit is your Profit and Loss (P&L) statement. This report summarizes your revenue and expenses over a specific period (usually monthly or annually). In addition to outlining your profit, the P&L statement highlights areas where expenses may be creeping too high. For example, a rising food cost percentage or escalating overtime pay will show up clearly in this report.

But here’s the catch: The P&L statement doesn’t show you what’s happening in your bank account. Your profit number is a mathematical calculation of business transactions, not a reflection of actual dollars available to pay bills or make payroll. That’s where cash flow comes into play and why relying only on your P&L can lead to misinformed decision-making.

What Cash Flow Really Means

While profit shows what’s left on paper, cash flow tells the real story of your restaurant’s financial health. Cash flow measures the movement of money in and out of your bank account. It includes all inflows, like sales revenue and investor contributions, as well as outflows, such as vendor orders, payroll, loan payments, and equipment purchases.

The main tool for tracking this is the cash flow statement. Unlike the P&L statement, which maps revenue and expenses to an assigned period, the cash flow statement tracks when money comes in and goes out.

For example, you might sell $50,000 worth of catering jobs in June, but if the client doesn’t pay the invoice until July, that money will appear on your June P&L statement but won’t hit your bank account until the following month. On paper, you had a profitable June, but in reality, you could have trouble meeting your financial obligations until the check clears the following month.

The key difference here is simple: Profit is theoretical, while cash flow is practical. In restaurants, managing cash flow effectively is what keeps the doors open.

Why Restaurant Owners Get It Wrong

It’s easy to see why so many operators blur the lines between cash flow vs. profit, despite these terms being restaurant accounting basics. The P&L statement is one of the most familiar reports in restaurant management, and many owners assume it reflects how much cash is on hand. But a P&L is not a measure of liquidity; it’s an accounting snapshot. Relying on it alone can leave you blindsided when bills come due.

Several other restaurant factors can make the numbers even trickier to read. Seasonal swings can mean your summer profits don’t carry you all the way through a slow winter. Vendor payment terms might require you to pay suppliers before you can collect money from clients. Inventory purchases tie up cash in shelves and coolers rather than in your bank account. Even worse, debts must be repaid, reducing your available cash without necessarily generating a positive profit.

This can paint an altogether different picture of your restaurant’s financial health than you may have expected.

Consequences of Mismanaging Cash Flow

Without a close eye on your cash flow, your restaurant can experience these significant and immediate consequences:

- Your team members expect to be paid on time every period, so a cash flow shortage that leads to even a short delay can damage trust and morale with your team.

- If invoices aren’t paid quickly, vendors may tack on late fees, adding unnecessary expenses and straining important supplier relationships.

- When your cash is tied up in simply covering the basics, you may miss important growth opportunities to invest in marketing, equipment, or expansion.

One of the most damaging ripple effects of poor restaurant cash management is the need to borrow money just to cover routine bills. Taking out short-term loans or leaning on lines of credit to fill gaps may get you through the month, but it comes with interest payments that erode your margins. Over time, this cycle eats into profit, leaving less flexibility to navigate future challenges.

How to Master Cash Flow vs. Profit

Understanding the difference between cash flow vs. profit doesn’t have to be overwhelming. With the right tools and some simple habits, restaurant owners can gain a clear picture of both their profitability and their day-to-day liquidity.

Robust Back Office software can make this easier than ever by offering real-time reporting, automated alerts, and dashboards that seamlessly connect the dots between your P&L statement, cash flow statement, and bank balance. Instead of waiting until month-end to discover a cash shortfall, you can spot restaurant financial health issues early and adjust on the fly.

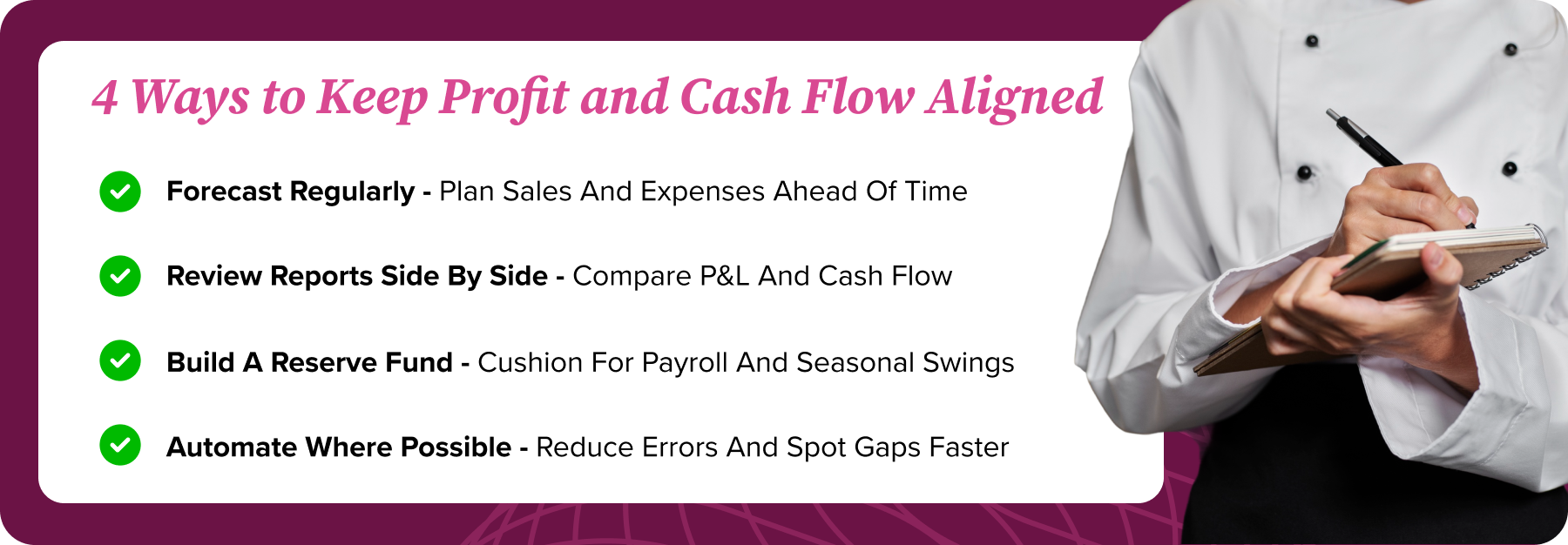

Beyond technology, the key is building better financial habits into your routine. Here are a few practical steps to keep profit and cash flow aligned:

- Forecast regularly: Project both your sales and your expenses, so you know when cash will come in and when big bills will go out.

- Review reports side by side: Don’t just read your P&L statement. Compare it with your cash flow statement (and other financial reports) to see the full picture of your restaurant’s financial health.

- Build a reserve fund: Even a small cushion can protect you from payroll stress, vendor late fees, or seasonal swings.

- Automate where possible: Use software to track vendor payments, schedule recurring expenses, and generate real-time cash flow reports. Automation can reduce human error and help you identify financial gaps sooner, so you can adjust accordingly.

Your Next Step Toward Financial Clarity

At the end of the day, profit and cash flow are two sides of the same coin, but they tell very different stories. Profit shows that your restaurant is sustainable, while cash flow shows whether you can meet your day-to-day obligations and keep your doors open. Both matter, but without cash flow, even the most profitable restaurant can run into serious trouble.

By understanding the difference between the two, and by using tools and strategies that help you manage both effectively, you can avoid unpleasant financial surprises and focus on what really matters: running a thriving restaurant that’s positioned for sustainable growth.

For a deeper dive into financial statements and accounting strategies, download our free guide: Mastering Restaurant Accounting. It’s packed with practical tips to help you stay on top of your numbers and build a stronger financial foundation for long-term success.