Let’s face it—restaurant operators juggle dozens of moving parts every day, making accurate restaurant accounting crucial. Though confusing, incomplete financial data is the last thing you need, that’s exactly what you get with basic cash-based accounting or generic bookkeeping tools.

Think about it. Your Friday night dinner rush involves credit card payments, mobile orders, vendor deliveries, staff overtime, and maybe even some catering deposits. Each of these transactions affects your bottom line differently—and hits your bank account at a different time.

That’s where the right accounting approach makes all the difference.

Why Traditional Accounting Falls Short in Restaurants

Cash-based accounting seems simple enough—record revenue when it comes in and expenses when they go out. For a small retail shop, that might work fine. But in restaurants? That’s like trying to navigate a busy kitchen while wearing a blindfold.

Here’s the reality: when you’re running a restaurant, you need the ability to gauge your full financial picture at any given moment, beyond your bank balance. Those vendor invoices sitting on your desk? They matter now, not just when you pay them. The staff working tonight? Those labor costs are piling up in real-time, even if payday is next week. That’s why specialized restaurant accounting systems are essential for success.

A Better Way: Accrual Accounting for Restaurants

Accrual accounting is a fancy term for a system that matches your books to your actual business operations. Recording income when earned and expenses when incurred—regardless of whether money changes hands—tells the full story of your restaurant’s financial health.

Let’s break down why this matters, across four key areas.

1. Taking Control of Inventory

Think about your walk-in cooler for a minute. With cash-based accounting, those just-delivered expensive steaks don’t show up in your books until you pay the invoice—which may not happen for weeks. Yet there they sit, representing both potential value and potential waste.

Accrual accounting tracks true food costs in real time, from the moment they arrive, better informing your decisions on menu pricing and specials. Further, it helps monitor inventory movement and shelf life, illuminating waste issues before they wreck your margins; you can base purchasing choices on real data rather than your bank balance.

Seasonal fluctuations become transparent, too. You’ll see patterns in your inventory needs and can adjust your purchasing accordingly. This visibility extends to cost forecasting for upcoming events and catering jobs, ensuring you’re properly prepared without overextending your resources.

Want to dig deeper into smart inventory management? Check out our guide on Streamlining Restaurant Inventory Management With Software and Automation.

2. Getting Smart About Labor Costs

Labor costs can make or break your restaurant. With accrual accounting, you register these costs as they happen, not just on payday. This real-time visibility can transform how you manage your team and their hours.

Instead of waiting for payroll to process, you’ll track real-time labor costs against real-time revenue, permitting immediate staffing adjustments. Real-time hour accumulation reveals overtime trends before they hurt your bottom line, resulting in scheduling decisions based on actual needs and historical patterns.

The impact of training hours, employee benefits, and payroll taxes becomes clearer as these costs accrue. You’ll be able to compare labor efficiency across different shifts and service types, helping you optimize your staffing patterns. Most importantly, you’ll see the relationship between labor costs and service quality, helping you maintain the right balance for your restaurant.

We dive more deeply into these concepts in our articles on Understanding and Managing Restaurant Labor Costs and Labor: Fixed vs. Variable Cost.

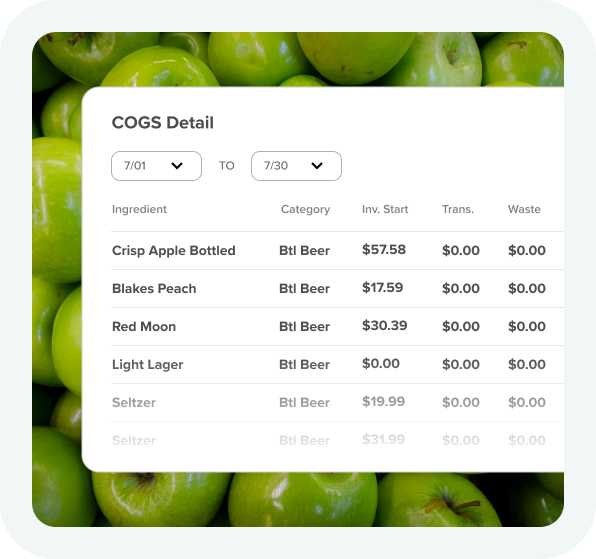

3. Mastering Your Cost of Goods Sold (COGS)

Want to know if your new menu prices make sense? With accrual accounting, you’ll see exactly how food costs align with sales, right down to individual menu items. This visibility helps you adjust pricing based on actual costs, including those fluctuating ingredient prices that can eat into your margins.

Seasonal trends become apparent before they impact profitability, informing smarter decisions about specials and promotions. You’ll track waste and spoilage in real time, helping identify problem areas before they become too costly. Vendor price changes and their impact on your margins come into focus, enabling better calls on portion sizes and plating.

The ability to compare actual versus theoretical food costs becomes a powerful tool for identifying potential issues in your kitchen. This deep understanding of your COGS helps you maintain profitability across your entire menu.

4. Managing Cash Flow Like a Pro

Yes, accrual accounting might slightly complicate your cash flow picture—but that’s actually a good thing. The right system can communicate all of your financial commitments in advance, helping you better plan for upcoming expenses, manage vendor payments strategically, and maintain good relationships while optimizing your cash position.

Examples abound. A proper accounting of processing fees makes credit card tips easier to manage. Pictures of historical patterns demystify seasonal changes. Tracking accounts receivable for catering and events becomes more accurate, and you’ll better understand your outstanding gift card liabilities.

This improved cash flow visibility helps you plan for equipment maintenance and replacement costs, understand the timing of tax obligations, and make informed decisions about reinvesting in your business.

Why Restaurant-Specific Accounting Systems Matter

Generic accounting software is like a Swiss Army knife when you need a chef’s knife—it might get the job done, but your execution will probably suffer. Restaurant-specific accounting solutions provide reports that actually make sense for your business, like daily sales analyses broken down by service period, labor cost percentages by department and role, and detailed variance analyses for food and beverage costs.

These specialized systems offer meaningful benchmarks, allowing you to compare your performance to that of peer restaurants in your market. They provide industry standard ratios for key performance indicators and help you understand seasonal market trends. Most importantly, they integrate with your point-of-sale systems, provide recipe costing tools, and offer the multi-unit reporting capabilities that growing restaurants need.

Want to get a better handle on your numbers? Start with our guide on Reading Your Restaurant Balance Sheet.

Making the Switch

Ready to collect on these improved financial insights for your restaurant? Here’s how to start the process.

Review Your Current Accounting Methods

Take a hard look at your current financial reporting capabilities and identify your blind spots. Think about your specific reporting needs and list out current pain points.

Consider Accrual Accounting

Think about how real-time financial management could improve your decision-making process. Map out your key financial decisions and identify areas where better data would help. Think about those seasonal challenges you face and consider your growth plans for the future.

Lean on an Expert

Working with a restaurant accounting expert can help ensure a smooth transition. Ask about their technology stack and discuss their approach to period-end closing. Make sure they can provide the reporting capabilities you need to grow your business.

Minimize Disruptions

Finally, plan for a transition that won’t disrupt your operations. Choose a strategic time for the switch, prepare your team for new processes, and establish clear communication channels. Your accounting system should work as hard as you do, providing clear insights and helping you make better decisions.

Need help making the switch? Our team specializes in restaurant accounting and can help you set up systems framed by your actual financial challenges and goals. Let’s talk about how better restaurant accounting methods can prime your business for maximal performance and profit.