Simplify payroll tax calculations and filings, and gain peace of mind with accurate tax compliance.

Back Office – Payroll – Payroll Taxes

Leverage highly trained tax agents who provide guidance and compliance assistance for tax regulations specific to the hospitality industry.

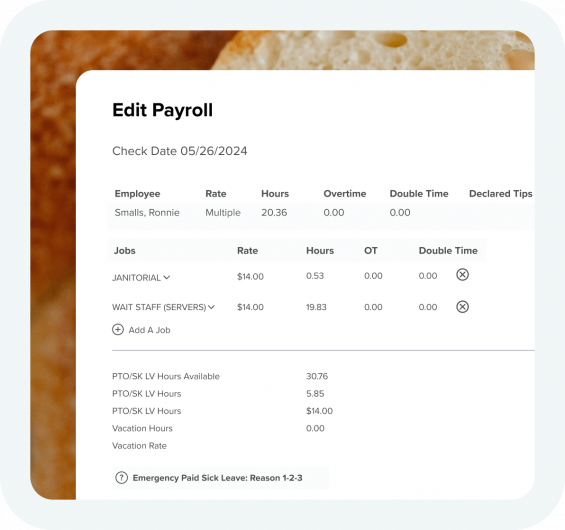

Our tax specialists have in-depth knowledge of the complex tax regulations that govern the restaurant industry. They understand the nuances of various tax laws, such as tip reporting, employee classifications, and industry-specific tax credits, ensuring compliance and avoiding costly penalties.

Save significant time and reduce the risk of errors so you can focus on core business activities, such as improving customer service and growing your restaurant, while our team handles the intricacies of payroll taxes efficiently.

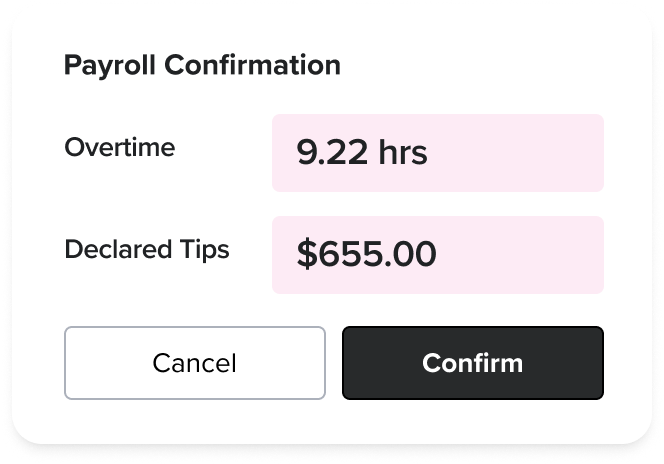

Ensure that all tax filings are accurate and submitted on time. This includes federal, state, and local tax returns, as well as other required reports. Accurate filings prevent underpayment or overpayment issues and protect you from potential audits.

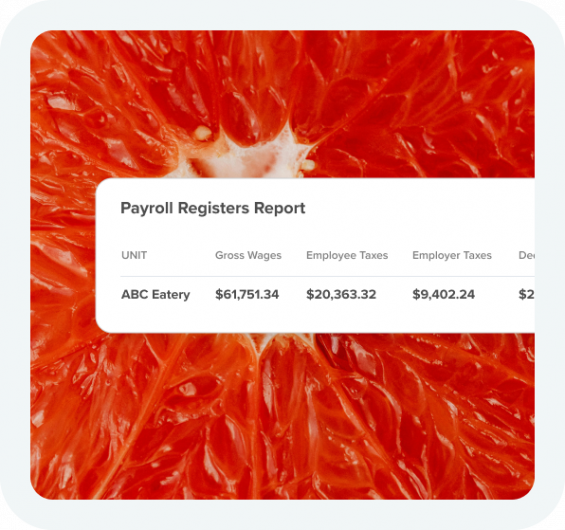

Back Office will automatically remit and file your Federal/State (if applicable) payroll taxes, Unemployment, Form 940 and 941 returns, State forms (if applicable), and provide annual W2s ensuring accuracy and compliance with all relevant tax laws.

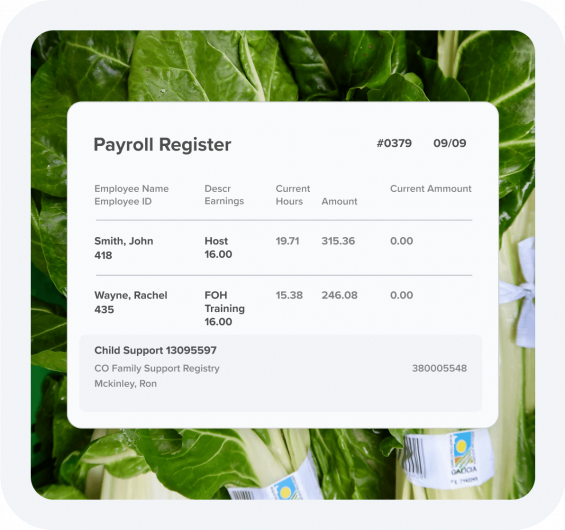

Offload the complex and time-consuming task of managing wage garnishments to the Back Office team. Our experts ensure that garnishments are calculated correctly, deductions comply with legal requirements, and payments are made on time. Stay in compliance while reducing administrative burden without worrying about potential payroll errors or penalties.

Our tax dashboard provides access to important tax documents and empowers you to understand your tax liability both before and after payment submissions – there are never any surprises as to how much, and when, money will clear your account!

Our dedicated compliance team understands the complexities of changing restaurant legislation, ensuring your operation is always compliant.

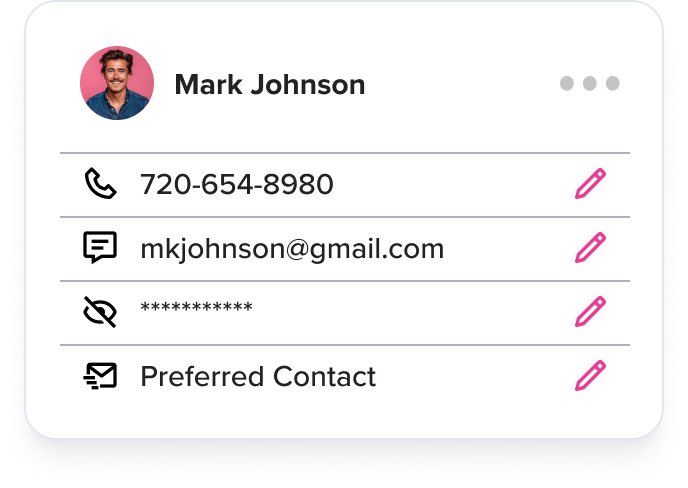

Empower your employees with direct access to their essential payroll documents and information through our user-friendly self-service portal.

Struggling with payroll tax management? Our solution automates calculations and filings, ensuring accuracy and compliance with ease. See how our payroll tax features can simplify your tax processes and reduce errors. Book a demo today!