Delivery has evolved from an optional perk to a core revenue stream for restaurants of all sizes. Whether you run a single-unit operation or oversee a multi-concept franchise network, partnering with the right restaurant delivery services can dramatically expand your reach and sales.

But there’s a catch: These services often come with steep commission fees, data privacy considerations, and operational complexities that can influence profitability. The best fit for one restaurant may not be right for another, so understanding those differences is essential. For operators comparing delivery apps for restaurants, the differences in fees, data access, and market reach can be decisive.

Comparing the Margins: Understanding the Cost of Delivery Apps

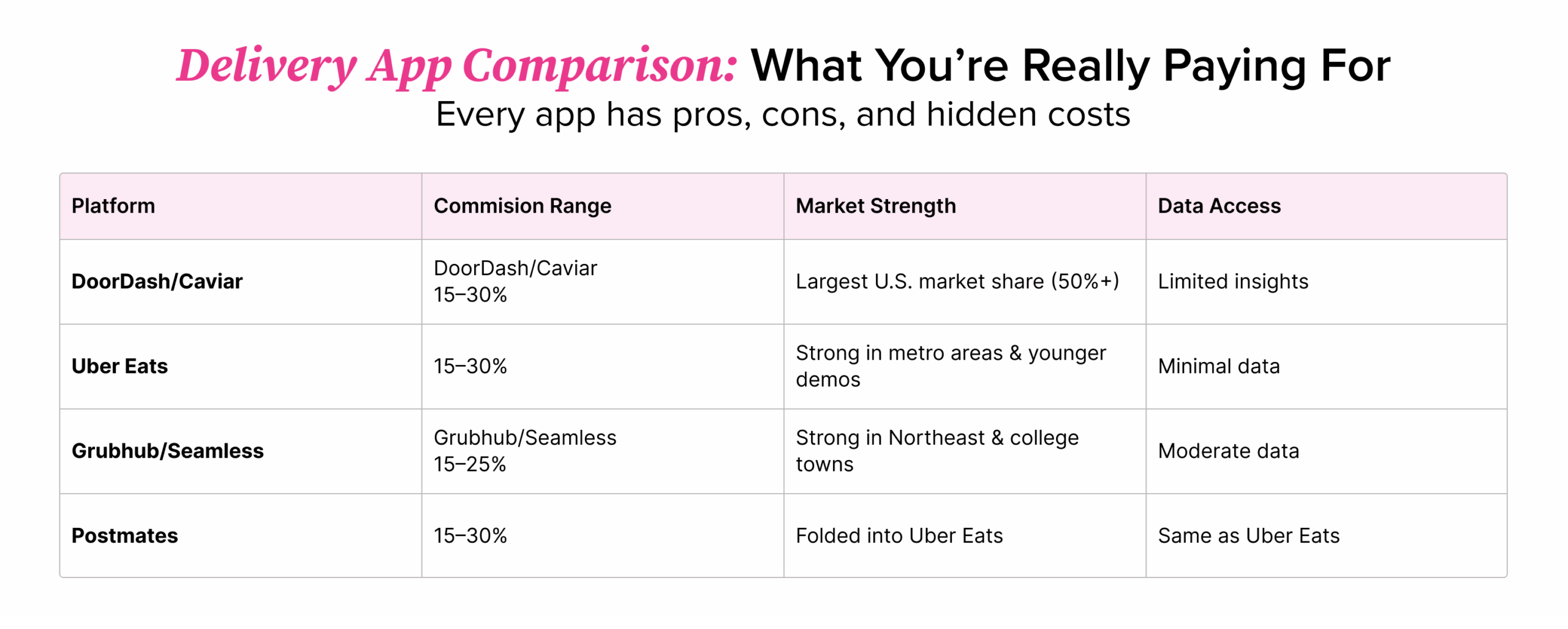

Third-party platforms make it easy to reach more customers, but that reach comes at a price. Understanding each platform’s typical commission structure is a crucial first step in deciding which will work best for your restaurant.

A $20 entrée with a 30% commission leaves you with just $14 before factoring in packaging, labor, and delivery-related operational costs. When conducting a food delivery comparison, factor these fees into your menu pricing strategy or consider raising delivery-only prices if the platform allows it.

DoorDash/Caviar

DoorDash is the largest U.S. delivery platform, controlling more than half of the market. It acquired Caviar, which focuses on trendier and higher-end restaurants, in 2019.

Commission fees typically range from 15–30% per order, depending on your plan, with optional marketing boosts that add more. In exchange, you gain access to an enormous customer base, especially in suburban and midsize markets. While restaurants receive minimal customer data and must handle strict menu accuracy requirements, DoorDash’s reach and order volume make it a cornerstone of many delivery strategies.

Uber Eats

Uber Eats charges similar rates — 15–30% per order — along with optional fees for priority placement. It performs especially well in large metro areas and among younger demographics who already use the Uber ride-share app.

Uber Eats also offers more aggressive promotional tools and data-driven marketing options than some competitors, which can help boost visibility if you’re willing to pay for it. However, restaurants receive very little customer data, so operators must monitor performance closely.

Grubhub/Seamless

Grubhub, which owns Seamless, charges around 15–25% per order, but sponsored listings can push fees closer to 30% or more. Its national market share has declined over the years, but it remains a key player in the Northeast, Midwest, and college towns.

Some operators appreciate its flexibility around slightly higher delivery menu prices, which can help offset commissions. For example, an item priced at $12 in-house might be listed at $13 or $14 on Grubhub to preserve margins once commissions, packaging costs, and longer prep times are factored in. This approach isn’t universally allowed on all platforms, so it can give operators slightly more control over profitability if local pricing-parity regulations permit it.

Grubhub also provides more customer data than most competitors, which supports loyalty-building efforts. However, its lower overall order volume means it may work best as part of a multi-platform approach.

Postmates

Postmates, now owned by Uber, has been largely folded into Uber Eats but still appears as a standalone option in some areas. Its commission structure is similar — typically 15–30% — and orders are fulfilled by the same courier network as Uber Eats.

While its standalone footprint has shrunk, Postmates can still generate incremental sales in certain markets, especially where it retains brand recognition. Operators considering it should treat it as an extension of Uber Eats rather than a separate platform requiring unique operational planning.

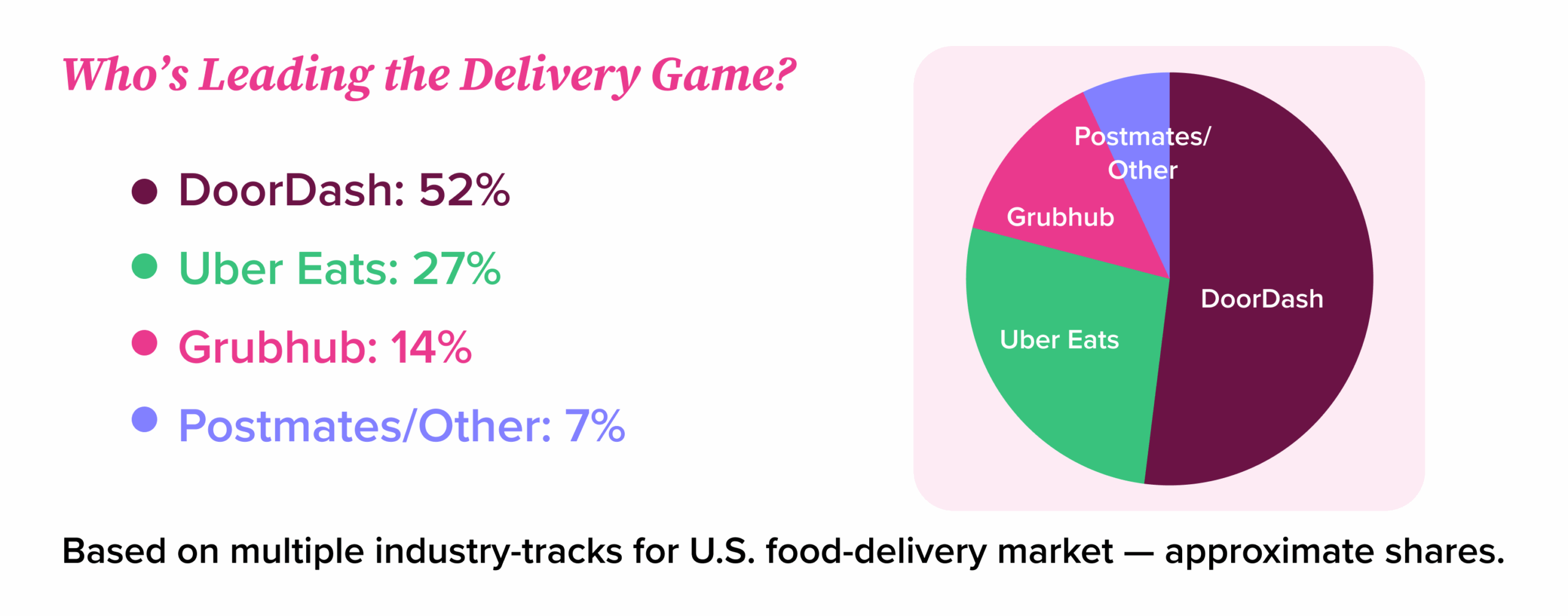

Who’s Ordering Where? Market Share and Regional Reach

Choosing the best restaurant delivery services also means understanding each platform’s user base:

- DoorDash controls more than half of the U.S. delivery market, so it’s widely available in many cities and suburbs.

- Uber Eats has a strong presence in large metro areas and among younger demographics who are already using the Uber ride-share app.

- Grubhub maintains traction in some Northeastern and Midwest markets, while its national footprint has waned.

Regional usage can vary dramatically. For example, college towns may lean heavily on Grubhub due to long-standing campus partnerships, while suburban areas tend to favor DoorDash. Mapping your customer base to each platform’s strongest markets can help you decide where to focus.

Exclusivity vs. Multi-App Strategy

Should you partner exclusively with one platform or diversify across several?

Some delivery apps offer lower commission tiers if you sign exclusive agreements. This can help you save on fees, but it may limit your reach and make you vulnerable if the platform experiences outages or policy changes. These tradeoffs are common across delivery apps for restaurants, so a pilot on one or two platforms before scaling can help de-risk the decision.

Operating on multiple platforms broadens your exposure but adds complexity. You’ll need to manage inventory syncing, price consistency, and multiple support channels. Evaluate your kitchen’s capacity and your POS system’s ability to handle multi-channel orders before committing.

Controlling Menu, Pricing, and Hours

Each platform has different rules on menu control, pricing flexibility, and operational hours. Some allow you to charge a premium for delivery to offset commissions; others cap delivery menu pricing at or near dine-in prices. It’s important to read the fine print because violating pricing parity rules can result in penalties or delisting.

Operators can optimize profitability by limiting delivery menus to high-margin, travel-friendly items. Remove fragile dishes that can fall apart or become soggy during transport. You could also consider bundling items into profitable combos or offering delivery only during peak demand hours. These options can help you boost delivery margins without overburdening staff.

How to Optimize for Delivery Apps

Success with restaurant delivery services involves a lot more than simply signing up. A restaurant’s listings need to attract clicks, convert orders, and earn repeat business.

Here are a few best practices:

- Photography matters: Invest in professional food photography. Menu items with appealing images tend to sell better.

- Refine names and descriptions: Be specific when describing dishes. Use “crave-worthy” language — and live up to the promise.

- Manage reviews proactively: Monitor ratings, respond to complaints quickly, and encourage happy customers to leave reviews.

- Keep prep times accurate: Overly optimistic time estimates can lead to delays, cancellations, and negative reviews.

These fundamentals apply across delivery apps for restaurants, regardless of platform.

Data Access and Privacy Considerations

While delivery apps handle ordering logistics, which can make things easier for the restaurant, the downside is that they often retain control of customer data, which prevents operators from building marketing lists.

Here’s how the most popular delivery services approach data sharing:

- DoorDash shares limited data, such as new versus repeat orderers, high-order zip codes, menu item performance, and customer feedback.

- Uber Eats shares sales, popular menu items, customer feedback, and overall satisfaction.

- Grubhub offers slightly more customer insights — total sales, total orders, average daily orders, and average order value.

Remember: All major platforms retain the right to use anonymized data for their own marketing and, in some cases, to sell to third parties.

Consider whether your POS or CRM system can help consolidate whatever data you receive. Protecting guests’ privacy while learning from available order trends is key to long-term success. Understanding this aspect is often overlooked, but it can directly affect your ability to build loyalty.

Using Back Office to Track Profitability

Delivery apps are tools — not silver bullets. They can drive growth, but only if you understand their costs, optimize your operations, and track how they affect your bottom line.

Back Office can help restaurant operators do exactly that. With real-time visibility into expenses, sales, and margins across channels, you can make informed decisions about how and when to use delivery platforms profitably. You can model different commission scenarios, test menu strategies, and allocate staff hours to balance in-house and delivery demand.

Choosing the Right Delivery Services

Delivery is becoming more deeply embedded in consumer behavior every year. Choosing the right restaurant delivery services can boost revenue, but picking the wrong ones can chip away at margins.

Before you commit to any platform, make sure you have a way to measure the real impact on your profits. That’s where Back Office comes in. With real-time visibility into expenses, sales, and margins across channels, you can see exactly how delivery commissions affect your bottom line — and adjust your strategy with confidence.

Looking for more best practices to strengthen your financial strategy? Download our free guide: Mastering Restaurant Accounting: A Guide for Operators, Franchisors & Franchisees.