Navigating California Minimum Wage Legislation: How AB 1228 Affects Quick-Serve Restaurants

In recent years, California has led the movement to increase the minimum wage. Assembly Bill 1228 (AB 1228), which went into effect April 1, 2024, requires quick-serve restaurants to pay employees a minimum wage of $20/hour.

In recent years, California has led the movement to increase the minimum wage. Assembly Bill 1228 (AB 1228), which went into effect April 1, 2024, requires quick-serve restaurants to pay employees a minimum wage of $20/hour.

In addition, AB 1228 established the nation’s first Fast Food Council, a consortium of foodservice workers, government appointees, and industry leaders tasked with setting standards, health and safety regulations, and potential future wage adjustments for California’s fast food industry.

This legislation represents significant changes in both labor costs and regulatory reporting, meaning that restaurants must stay diligent to maintain efficiency and compliance. Busy restaurant owners and operators keen to protect their bottom line are considering software solutions to this novel problem, specifically technology that keeps track of payroll, bookkeeping, and accounting.

Table of Contents:

- Which Restaurants Are Subject to AB 1228?

- Exclusions From AB 1228

- Paying a Living Wage While Protecting Your Financial Health

- Payroll Automation To Streamline Labor Costs

- Reduce Staffing Needs and Stay Compliant

- Restaurants Must Adapt to a(nother) New Normal

Which Restaurants Are Subject to AB 1228?

To fall under the purview of AB 1228, a restaurant must satisfy specific requirements. First, the facility must be categorized as a limited-service restaurant located in California, offering minimal or no table service, with customers generally ordering and paying upfront (prior to eating or drinking). The main commercial operation should be the provision of food and beverages for immediate consumption.

Second, the restaurant must be part of a franchise or chain that includes at least 60 stores. This count includes locations that directly serve food or beverages to customers and excludes sites focused on administrative functions, storage, or meal prep areas without direct-to-consumer sales.

Exclusions From AB 1228

While these criteria are clear, there are two notable exceptions: bakery-operated restaurants and fast food enterprises inside grocery stores.

The legislation defines bakery-operated restaurants as eateries that include an operational bakery that, as of September 15, 2023, produced and offered bread as an individual menu item. The bread in question, after cooling, must weigh at least eight ounces and be sold as a standalone item.

Fast food restaurants inside grocery stores must also meet certain guidelines for exclusion. The encompassing grocery store needs to span more than 15,000 square feet, with its primary business being the sale of food products for consumption outside the supermarket. Additionally, the fast food restaurant must be an integrated part of the grocery store’s operations.

Paying a Living Wage While Protecting Your Financial Health

The immediate impact of AB 1228 is twofold. First, it places California at the forefront of labor rights innovation; by raising the minimum wage to $20 per hour for quick-serve restaurant employees, the state recognizes the critical role these workers play in its economy and the challenging conditions they face. Second, while its passage is a win for labor advocates, it presents significant challenges for quick-serve restaurants, which tend to rely heavily on labor-intensive solutions and operate on tight profit margins.

These operators must strategically reevaluate in order to meet increased labor costs without compromising service, quality, or profitability. Some are turning to traditional solutions, including creative staffing and adjustments in pricing, while others are considering technological innovations that cut costs.

Payroll Automation To Streamline Labor Costs

Higher wages imposed by AB 1228 have the potential to significantly impact profitability via increased labor costs. For example, some restaurant brand locations in the state number more than 60, but far less than that of the largest quick-serve chains. Margins can still be quite tight at this stage of brand growth.

When restaurants incur higher operating costs due to increased wages and new regulation, they must decide whether to absorb these costs or pass them on to customers through price increases. To mitigate the need for significant price jumps, some may look to make up the difference elsewhere, through, for example, more cost-effective sourcing, tiered or dynamic pricing, or reworked menu offerings with higher profit margins.

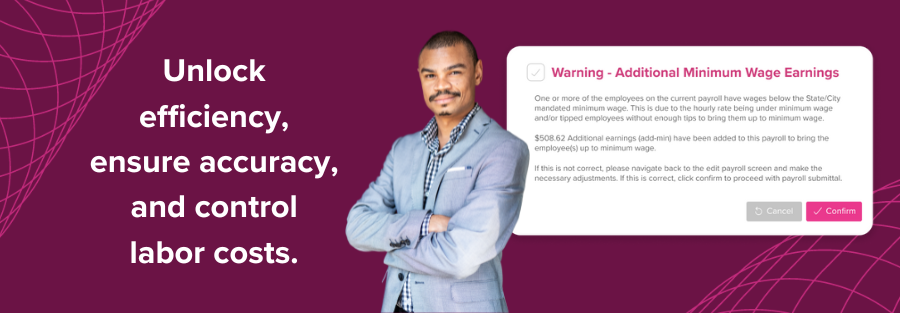

Other restaurant operators turn to technology to improve operational efficiency. Implementing an automated payroll system like Back Office delivers many cost-saving benefits, by eliminating manual data entry, saving administrative time and effort, and reducing human errors in payroll calculations.

Additionally, Back Office offers insights into payroll expenses, allowing for better budgeting and cash flow management. Its real-time dashboards allow operators to track sales and labor metrics to optimize staffing levels and minimize unnecessary overtime. Savings from these efforts can help offset higher labor costs without directly impacting pricing.

Reduce Staffing Needs and Stay Compliant

Back Office also helps restaurant operators better monitor bookkeeping and accounting. Instead of hiring staff members to complete these tasks, or outsourcing to a third party, you can implement team-backed software that fills these roles and then some.

Back Office also helps restaurant operators better monitor bookkeeping and accounting. Instead of hiring staff members to complete these tasks, or outsourcing to a third party, you can implement team-backed software that fills these roles and then some.

Additionally, the Back Office compliance team works with users to ensure that policies, procedures, and internal documents are up-to-date and adhere to state and federal laws. Avoiding compliance and payroll errors helps brands avoid potential fines and unnecessary fees.

Restaurants Must Adapt to a(nother) New Normal

AB 1228 significantly changes California’s minimum wage landscape—and with the success of the Fight for $15 movement, more states are likely to enact similar legislation. By understanding the law’s implications and implementing proactive strategies, such as leveraging software to control labor costs, restaurant operators can stay competitive and profitable in an evolving regulatory environment. Regardless of your AB 1228 workaround, the mandate for California quick-serve restaurant operators is clear: embracing change and innovation can be your ticket to thrive in this new economic reality.