When and How to Switch Your Accountant

Table of Contents:

- Trouble with Traditional Accounting

- How to Tell When It’s Time to Switch

- Finding the Right Restaurant Accounting Solution

- The Future of Restaurant Accounting

- Accounting Services That Drive Profitability

In this white paper, you’ll find out why it’s time to ditch your traditional accountant and embrace the wonders of Back Office technology.

Ah, accounting—the glamorous world of numbers, spreadsheets, and endless hours spent staring at receipts. We get it; the mere thought of accounting might make you want to dive headfirst into a bowl of spaghetti carbonara. But fear not, dear foodservice operator, for we have a solution to transform your accounting woes into a cakewalk.

The Trouble with Traditional Accounting

Picture this: stacks of paper receipts, hours spent deciphering illegible handwriting, and the constant dread of tax season. If this sounds like your current accounting situation, you’re not alone. Traditional accounting is about as thrilling as watching paint dry. It’s time-consuming, prone to human errors, and downright uninspiring.

Receipt Roulette

Receipt Roulette

Traditional accountants have a knack for making you play “Receipt Roulette.” You hand over a pile of crumpled, faded receipts, and then you pray they’ll magically transform them into tidy financial statements. Spoiler alert: magic isn’t real, and neither are error-free traditional accountants.

Tax Season Nightmare

Tax Season Nightmare

When tax season rears its ugly head, traditional accountants disappear into their cave, emerging only when they’ve deciphered your financial labyrinth. Meanwhile, you’re left to ponder the meaning of life, wondering when your tax headache will finally subside.

Now that we’ve gone over some of the challenges of traditional accounting, it’s time to explore a better way forward. Let’s dive into when and how to switch from using an accountant to leveraging technology.

Recognizing the Signs: How to Tell When It’s Time to Switch

It’s the time of the year to re-evaluate your current processes and procedures. There’s no better time than now to make adjustments. If you find yourself wrestling with your accounting system and feeling like it’s holding your business back, it might be time for a change.

Let’s shed light on 7 signs that should prompt you to evaluate your current accounting situation and consider making the switch to modern accounting technology.

1) Tax Season Dread:

Annual tax season dread indicates your current accountant’s inefficiency.

2) Receipt Roulette:

Playing “Receipt Roulette” signals outdated manual processes.

3) Data Delays:

Constant delays in accessing financial data hinder decision-making.

4) Rising Costs:

Escalating accounting fees strain your budget.

5) Inefficiency and Errors:

Frequent errors reveal accounting system unreliability.

6) Limited Accessibility:

Restricted access to financial records limits convenience.

7) Growth Hindered:

Business growth stalls due to accounting constraints.

Now that we’ve identified the critical signs, you’re well-prepared to take the next step toward a more efficient future. In the following section, we’ll guide you through the essential steps to find the ideal accounting solution for your foodservice operation.

Making the Switch: Finding the Right Restaurant Accounting Solution

Enhancing your restaurant operation’s financial management is a wise decision, and we’re here to help you navigate it smoothly. In this section, we’ll break down the essential steps to finding the perfect accounting solution that aligns with your unique needs and goals.

Step 1: Define Your Requirements

Begin by clearly outlining what you need from your accounting system. Consider factors such as the size of your business, the complexity of your financial transactions, and your future growth aspirations. By defining your requirements upfront, you’ll be better equipped to narrow down your options.

Step 2: Assess Your Budget

Understanding your budget constraints is crucial. Determine how much you’re willing to invest in an accounting solution. While modern technology can streamline your financial processes, it’s essential to strike a balance between cost and benefits.

Step 3: Research Accounting Technology

Explore the diverse range of accounting technologies available in the market. From cloud-based platforms to specialized restaurant accounting software, there are various options to consider. Research thoroughly to identify which solutions align with your requirements and budget.

Step 4: Evaluate Scalability

Consider your business’s growth potential. A scalable accounting solution should adapt seamlessly as your restaurant or foodservice operation expands. Assess how each option accommodates future growth.

Step 5: Request Demos and Trials

Don’t hesitate to request demos or free trials from the accounting technology providers you’re interested in. Hands-on experience will help you gauge the user-friendliness and suitability of the solution for your specific needs.

Step 6: Check Integration Compatibility

Ensure that the accounting solution you choose can integrate with your existing systems, such as POS systems, payroll software, or inventory management tools. Smooth integration minimizes data entry and maximizes efficiency.

Step 7: Assess Data Security and Compliance

Security is paramount when dealing with financial data. Verify that the accounting solution complies with industry-standard security measures and relevant regulations.

Step 8: Consider Support and Training

Evaluate the level of training provided by the solution’s provider. Reliable support and comprehensive training can make your transition to the new system seamless.

Step 9: Make an Informed Decision

After careful consideration of these factors, make an informed decision that aligns with your business objectives. Remember that the right accounting solution can streamline your financial management, saving you time and reducing errors.

By following these steps, you’ll be well on your way to selecting the perfect accounting solution to propel your foodservice operation into a future of efficiency and success.

The Future of Restaurant Accounting

As a forward-thinking restaurant operator, you should be at the cutting edge of your industry. Embracing technology in accounting isn’t just a smart move; it’s a glimpse into the future.

Cost Savings and Efficiency

Cost Savings and Efficiency

Let’s talk money—because that’s what accounting is all about, right? Switching to technology doesn’t just make accounting less dreadful; it also saves you a pretty penny.

Seamless Integration

Seamless Integration

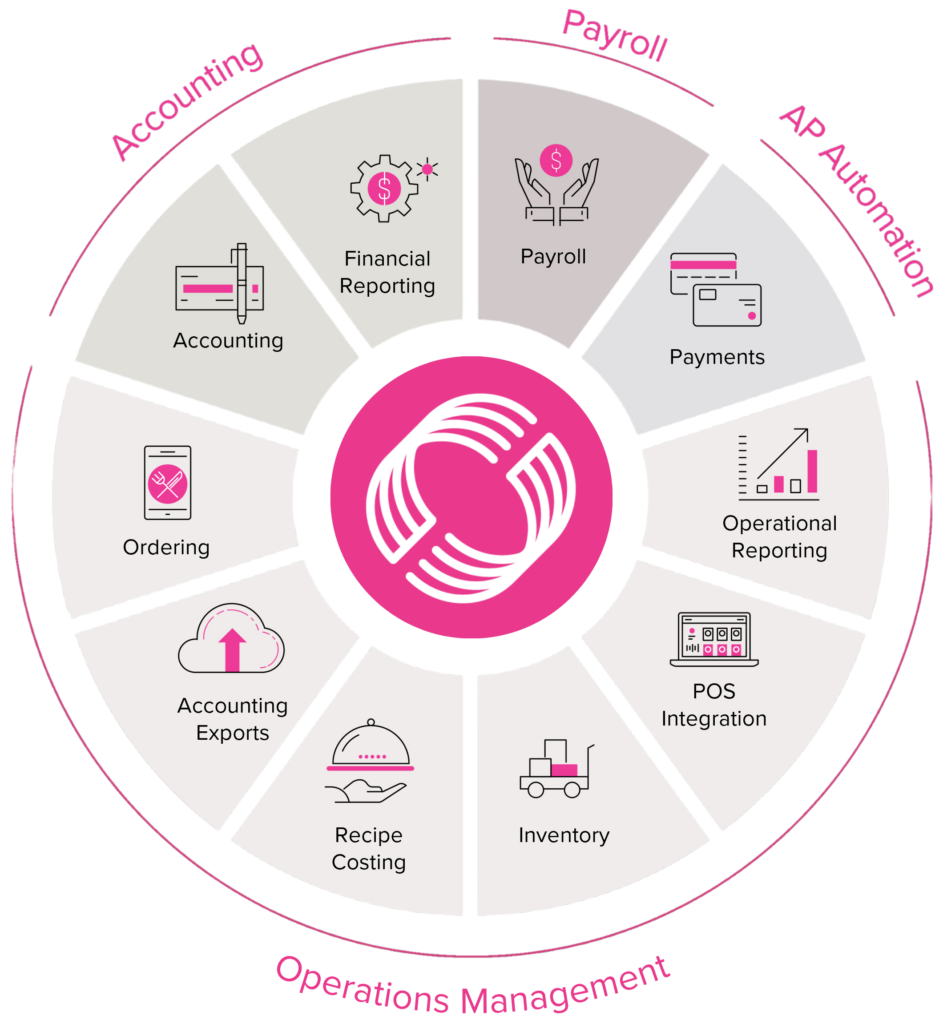

Modern accounting software easily integrates with other tools you use, from point-of-sale systems to inventory management. It’s like having a symphony of tools working together to create financial harmony.

Scalability & Growth

Scalability & Growth

Ready to expand your food empire? Technology scales with you, accommodating your growth effortlessly. No more headaches when you open a new location or expand your menu.

Reduce Human Error

Reduce Human Error

Traditional accountants are only human, and humans make mistakes. Technology, on the other hand, is relentless in its precision, reducing costly errors and ensuring your financial records are impeccable.

Time is Money

Time is Money

Remember all those hours wasted in Receipt Roulette or waiting for your traditional accountant to emerge from their tax season hibernation? With technology, you’ll save time that can be better spent improving your foodservice operations or simply enjoying a well-deserved break.

In an industry where every minute counts and precision is paramount, the choice between traditional accounting methods and modern technology can be the difference between thriving and merely surviving. As we’ve explored in this whitepaper, the woes of traditional accounting, from the chaotic receipt roulette to tax season nightmares, can impede your growth and hinder your financial success.

Recognizing the signs that it’s time to switch is the first step toward a more streamlined and brighter financial future. The path forward is clear: embracing accounting technology. By following the steps we’ve outlined to find the right accounting solution for your unique needs and goals, you can streamline your financial management, reduce errors, and save valuable time and resources.

Accounting Services That Drive Profitability

As an industry professional you know the value of precision and efficiency. It’s time to apply that same dedication to your restaurant’s financial management.

We totally get it – accounting can be a real headache, especially in the restaurant industry. But fear not, because we’re here to make your life easier and your restaurant more profitable.

Here’s a taste of what we bring to the table:

Industry Expertise: Let’s face it, you’ve got enough on your plate. That’s why we’ve assembled a team of restaurant accounting experts who speak your language. They’re not just number crunchers; they’re your secret sauce to increasing efficiencies and gaining actionable insights that actually impact your operational results.

Financial Accounting Reports: We know you need to keep your finger on the financial pulse of your restaurant, but who has time for that? Our expert bookkeeping comes with a weekly financial package that’s as accurate as your grandma’s secret recipe. These financial statements aren’t just pieces of paper; they’re your recipe for success. With them, your team can make timely adjustments that’ll send your profitability soaring.

Balance Sheet Reviews: Balancing the books can feel like trying to juggle flaming meat cleavers, but our team is here to ensure your business’s assets, liabilities, and equity are all in harmony. These reviews aren’t just paperwork exercises; they’re the key to making educated decisions that’ll help your restaurant grow and become even more profitable.

Operational Evaluations: It’s not just about looking back; it’s about looking forward. We’re here to engage your management team, set goals, and create measurements for the future. By providing in-depth analysis on current results compared to industry standards, we’ll help you stay ahead of the competition.

Cash Management Reporting: Money matters, and we get that. That’s why we offer complete transparency into your cash position. With daily and weekly reconciliations, you’ll always know where your restaurant stands financially. No more surprises; just smooth sailing.

Comparative Accounting Cycles: We know that one size doesn’t fit all. That’s why we offer accounting cycles that work for your business, whether it’s the 13-period, 445, or 544. We’re all about flexibility because we understand that your restaurant is as unique as your signature dish.

So, if you’re tired of wrestling with spreadsheets and drowning in financial jargon, it’s time to partner with Buyers Edge Back Office. We’re here to take the accounting burden off your shoulders so you can focus on what you do best – serving up delicious meals and satisfying your customers.

Download the full When and How to Switch Your Accountant White Paper PDF

Complete and submit this form to receive your free digital download