Insights and education to streamline restaurant operations and drive profitability.

Every restaurant owner imagines running the kind of place you see in commercials—the manager greets regulars by name, the team members are always smiling, and the food is always beautifully presented, hot and fresh, at the table. But behind the scenes, the realities of keeping a restaurant running often look

Back Office

Back Office

Restaurant technology has never been more powerful—or more confusing. Between POS upgrades, inventory platforms, labor tools, and analytics dashboards, operators are often swimming in software, yet still struggling with visibility,

Back Office

Back Office

If your bottom line isn’t where you’d like it to be, there’s a good chance that food waste is at least partially to blame. Whether it’s spoiled food that never

Back Office

Back Office

Over the past few years, artificial intelligence (AI) has fundamentally reshaped how food businesses forecast demand, manage labor, control inventory, and protect margins. From predictive scheduling to automated purchasing, the

Back Office

Back Office

Not long ago, restaurant operators relied mostly on intuition to navigate challenges like rising costs, unpredictable labor markets, and late-night reconciliations. Those instincts still matter, but data and automation are

Back Office

Back Office

Bookkeeping may not be the flashiest part of running a restaurant, but it is one of the most important. Every service brings in dozens — perhaps hundreds — of transactions

Back Office

Back Office

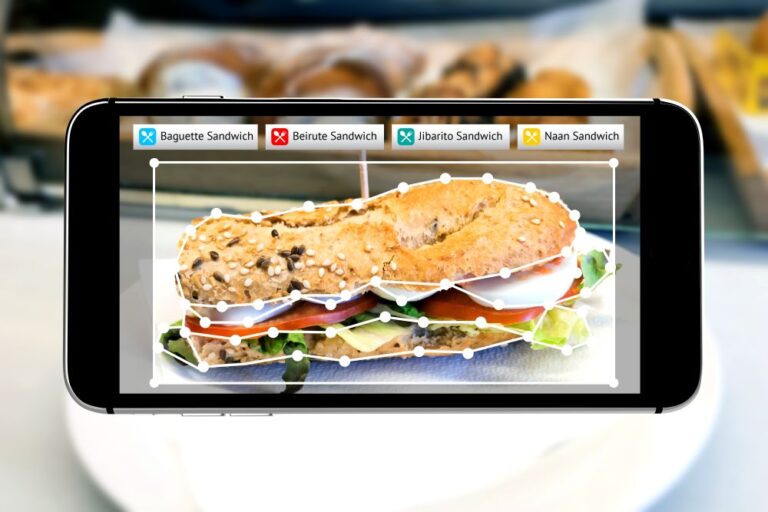

Artificial intelligence (AI) isn’t just transforming the way restaurants operate. AI in foodservice is redefining the entire ecosystem. From voice-activated ordering to predictive inventory and robotic kitchens, AI has evolved

Back Office

Back Office

Delivery has evolved from an optional perk to a core revenue stream for restaurants of all sizes. Whether you run a single-unit operation or oversee a multi-concept franchise network, partnering

Back Office

Back Office

Running your restaurant at peak efficiency would be a whole lot easier if you knew in advance when your busiest shifts would be, which dishes customers were going to order,

Back Office

Back Office

Every ingredient in your kitchen represents cash on the shelf. How you manage that cash determines whether it fuels growth or quietly erodes your margins. Mastering restaurant inventory management best

Back Office

Back Office

From order totals and labor hours to social reviews and inventory usage, restaurants generate thousands of data points each day. But many operators let this valuable information go untapped. Data

Back Office

Back Office

When restaurant owners think about profitability, food and labor costs typically come to mind first. But there’s another factor that’s often overlooked: restaurant layout, which can have a big impact

Back Office

Back Office

AI for restaurants is no longer a futuristic concept reserved for large chains — it’s a practical tool transforming how restaurants operate every day. From smarter scheduling and forecasting to

Back Office

Back Office

Understanding how to calculate food cost — and then applying those figures strategically to business operations — is a prime driver of restaurant success. It’s a reality many seasoned restaurant

Back Office

Back Office

Imagine having a crystal ball for your restaurant — one that shows tomorrow’s busiest shifts, next week’s top-selling menu items, and the guests who are most likely to visit. That’s

Back Office

Back Office

In the restaurant business, every detail matters, and few details are as powerful as your menu. Beyond showcasing dishes, the menu acts as a silent salesperson, shaping how guests order

Back Office

Back Office

You just closed the books for the month, the P&L shows a healthy profit, and yet, your bank account is running on fumes. How can that be? For restaurant operators,

Back Office

Back Office

As a restaurant operator, understanding the financial nuances of your operation is a crucial part of your ongoing success. Although some people may use the terms “recipe costing” and “food

Back Office

Back Office

That $15,000 commercial pizza oven you bought three years ago isn’t worth $15,000 anymore—and that’s actually a good thing for your taxes. Restaurant equipment loses value over time through normal

Back Office

Back Office

Labor is one of the most significant expenses in the restaurant business. Yet, without a clear understanding of your payroll percentage, it’s nearly impossible to know whether you’re overstaffed, understaffed,

Back Office

Back Office

The most successful restaurants coach their management teams to keep a finger on the pulse of finances by regularly revisiting the question, “What is prime cost?” Many restaurants calculate prime

Back Office

Back Office

Most restaurant operators approach pricing with a simple cost-plus formula: calculate food costs, then multiply by three. That approach might keep the lights on, but it’s leaving money on the

Back Office

Back Office

When it comes to building or growing a restaurant, few decisions are as financially significant as how you acquire your kitchen equipment. Whether you’re opening your first unit, renovating an

Back Office

Back Office

Choosing the right restaurant accounting software isn’t just about managing your books — it’s about setting your business up for smarter decisions, smoother operations, and long-term profitability. Generic accounting tools

Back Office

Back Office

Running a restaurant isn’t for the faint of heart — especially with the current litany of industry challenges. Labor costs are through the roof, profit margins keep shrinking, tariffs are

Back Office

Back Office

Running a restaurant involves more than just scheduling and inventory management—you also have to play by some truly bizarre rules when it comes to alcohol. What’s legal in one state

Back Office

Back Office

Tariffs have increasingly grabbed the nation’s attention. They’re gobbling up space in the mainstream media, weaving into everyday conversation, and the constant changes are stirring both concern and confusion among

Back Office

Back Office

Proper liquor cost management doesn’t just impact profits—it also helps you identify shrinkage, prevent theft, manage inventory more effectively, and set prices that align with your financial goals. For new

Back Office

Back Office

Successfully closing out a period sets the foundation for effective restaurant financial management, helping you avoid missed opportunities in future periods. If your last financial period ended in a blur

Back Office

Back Office

In the restaurant industry, success is served on many different plates. From independent cafés to multi-location enterprises, each operation tells its financial story through the same document: the Profit and

Back Office

Back Office

Let’s face it — running a restaurant means juggling dozens of moving parts every day, and your financial management shouldn’t be another headache. Yet many operators struggle with a fundamental

Back Office

Back Office

In 2025, running a restaurant requires more than just great food and customer service—it demands cohesive operational efficiency powered by smart technology. Yet, many restaurant operators still struggle with siloed

Back Office

Back Office

Egg prices have surged in recent months. Whether it’s a brunch café or a quick-service restaurant that relies on eggs for the breakfast daypart, operators everywhere are feeling the squeeze.

Back Office

Back Office

General Managers are the heartbeat of any successful restaurant operation. Their leadership, adaptability, and execution skills determine both the short-term and long-term success of the business. Yet GMs often face

Back Office

Back Office

Running a restaurant is no easy feat. Between managing fluctuating costs, navigating razor-thin profit margins, and juggling compliance with financial regulations, restaurant accounting can feel like a full-time job in

Back Office

Back Office

Payroll management in the restaurant industry is complex and time-consuming. From tracking hours and calculating tips to managing compliance with ever-changing tax laws, your payroll process can significantly drain resources.

Back Office

Back Office

In October 2024, the FDA rolled out its revamped Human Foods Program (HFP), a landmark initiative designed to unify food safety and nutrition regulations. For restaurants, this program represents a

Back Office

Back Office

Making time to manage invoices is a necessary but often dreaded task in the restaurant industry. The process is time-consuming, requiring your team to juggle manual data entry, reconcile invoices,

Back Office

Back Office

Cash flow management is vital to the immediate performance, stability, and long-term success of any restaurant business. Closely monitoring your restaurant cash flow statement – a detailed record of the

Back Office

Back Office

Profit margins in the restaurant industry are razor-thin, and every dollar wasted in operations is a dollar lost from the bottom line. Many restaurants unknowingly hemorrhage money through avoidable direct

Back Office

Back Office

Running a successful restaurant isn’t just about creating great recipes or a unique atmosphere. To be sustainable, your restaurant must manage costs effectively, and Cost of Goods (COGS) has one

Back Office

Back Office

Restaurant labor cost represents one of the largest expenses for restaurants, often accounting for 25–30% of total sales. Managing these costs efficiently is critical for profitability and operational sustainability. Labor

Back Office

Back Office

Understanding Restaurant Tax Obligations The months leading up to tax season can be a stressful time for restaurant owners. In addition to managing PTO requests and hosting parties and houseguests

Back Office

Back Office

Let’s face it—restaurant operators juggle dozens of moving parts every day, making accurate restaurant accounting crucial. Though confusing, incomplete financial data is the last thing you need, that’s exactly what

Back Office

Back Office

A strong focus on food waste in restaurants is not just a sustainability measure to help with brand image; food waste directly affects your bottom line and can often have

Back Office

Back Office

In today’s competitive food industry, restaurant operations are the cornerstone of efficiency, profitability, and long-term success. While innovative menus and creative marketing strategies may attract diners, it’s operational excellence that

Back Office

Back Office

One of the most critical expenses in managing a restaurant is labor. From wages to payroll taxes, the complexity of managing labor directly affects your success, and management teams need

Back Office

Back Office

Seattle’s restaurant industry is poised for a seismic shift in 2025 as small businesses brace for a significant wage increase. On January 1, 2025, the city’s minimum wage will rise

Back Office

Back Office

Understanding and managing restaurant labor costs plays a significant role in profitability and is crucial for your management team to understand. Labor costs include wages, benefits, payroll taxes, and other

Back Office

Back Office

Imagine applying the meticulous precision of engineering to the art of crafting a restaurant menu. Menu engineering is not just about listing dishes; it’s a strategic blueprint for boosting profits

Back Office

Back Office

For restaurant owners, recipe costing is an ongoing operational concern. Savvy managers understand that as food costs change, so will individual recipe costs. Keeping up with these price fluctuations can

Back Office

Back Office

Every restaurant owner imagines running the kind of place you see in commercials—the manager greets regulars by name, the team members are always smiling, and the food is always beautifully

Restaurant technology has never been more powerful—or more confusing. Between POS upgrades, inventory platforms, labor tools, and analytics dashboards, operators are often swimming in software, yet still struggling with visibility,

If your bottom line isn’t where you’d like it to be, there’s a good chance that food waste is at least partially to blame. Whether it’s spoiled food that never

Stay updated with our latest news and insights! Get valuable tips and updates delivered right to your inbox each month.

Unlock your restaurant’s potential with a personalized demo of our solutions and explore how we can fuel your growth and success!